Blog entry by Glinda Baylor

It's clear that Discretionary Counts on make up a substantial proportion of that number because of their appeal for organization, investment and estate preparation. Trustees that are not able to give a great reason for a rejection will certainly run the risk of being directly accountable for Court prices, needs to a conflict get to that factor. Furthermore, beneficiaries can apply to the Court to have the trustee removed or changed.

Estate Preparation Ideas

- The trustee( s) should follow a stringent process when picking to invest depend on possessions.

- As the present exceeds Helen's available NRB of ₤ 325,000, an excess of ₤ 75,000 occurs and tax due on this totals up to ₤ 15,000.

- The trustee has a large amount of discretion over exactly how the depend on funds are made use of, and there is no demand for a beneficiary to be notified of all the depend on choices.

- Simply put, optional depends on are a good estateplanning device for those beneficiaries who might need extra support managinglarge amounts of money.

- The rate of tax on the departure is a proportion of the price charged at the previous 10 year anniversary.

A household trust has a series of benefits for an individual's properties on asset protection and tax obligation factors, https://essex.directwillstrusts.co.uk/when-to-update-your-will/ along with peace of mind. The grantor can establish guidelines on when depend on properties ought to be dispersed and how much each count on recipient need to obtain. However again, it's up to the trustee to determine what selections are made when it come to distributions of principal and passion from depend on possessions. While they might look for distributions, it depends on the trustees to identify whether the repayment will be made according to the optional direction. Helen dies in between 4 & 5 years after making her gift into optional trust, the gift was ₤ 400,000 (presume tax was paid from the trust fund) and the NRB offered at the day of her fatality is ₤ 325,000. As the present exceeds the NRB, the tax obligation on the present is recalculated utilizing the full death price.

Lawful Guidance

Trust funds not just for super rich Business - News24

Trust funds not just for super rich Business.

Posted: Mon, 01 Jun 2015 07:00:00 GMT [source]

Although not lawfully binding, this gives trustees assistance on just how the settlor would such as the depend be provided. The expression of desires could stipulate, for example, that the recipients must receive just revenue and not capital, or that possessions ought to be dispersed on a beneficiary's 21st birthday. When an optional trust is produced, the transfer of assets right into the trust is subject to an immediate analysis to Inheritance Tax ( IHT).

A discounted present trust is a count on which allows customers to give away assets for IHT functions, whilst still retaining a right to take normal withdrawals throughout their lifetime. The worth of the present (the costs paid to the bond) is potentially discounted by the value of this retained right (in fundamental terms, the right to receive withdrawals is valued) to lower the responsibility to IHT instantly. Under the lending trust fund plan a settlor designates trustees for a discretionary depend on and makes a lending to them on an interest-free basis, repayable as needed. The trustees after that typically spend the money right into a solitary premium bond (life assurance or funding redemption variation) in the name of the trustees. The loan is repayable to the settlor as needed and can be paid on an impromptu basis or as regular settlements (withdrawals).

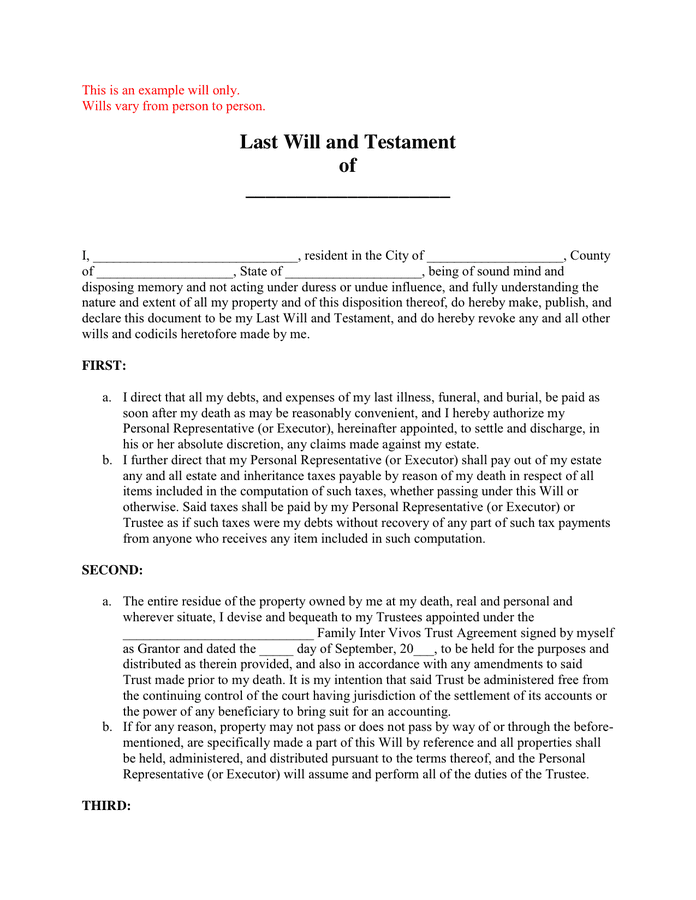

When establishing a count on, using an optional count on offers peace of mind due to the defenses this kind of depend on provides to your loved ones who may not have the skills needed to guard the properties you provide to them. Usually, when making a Will, you call individuals that you want to get your estate when you die, referred to as your beneficiaries. However, there might be conditions where you would choose that your estate does not go directly to the beneficiaries when you pass away, yet rather, that it is held on behalf of those recipients in a specific means. The people holding the assets in support of the recipients are referred to as your trustees. Trustees are nominated in the Will to administer the trust fund in your place. For additional information, please enter get in touch with so that among our legal professionals can review this with you.

Therefore, the count on's entire income or resources will be dispersed to unit holders prior to any kind of tax obligation is deducted. Compared to discretionary trusts where the shares are alloted at the discretion of the recipients, device trusts designate shares of the residential property in behalf of the recipients in the trust. Device depends on assign and recognize a "unit" in the trust fund residential or commercial property beforehand, in accordance with the recipients' percentage of "devices".

The trustees can make a decision which of the beneficiaries get a distribution, how much they get and when they receive it. It is essential that trustees are people you trust fund, as you essentially hand all choices over to them. Discretionary trust funds are a kind of unalterable trust fund, meaning the transfer of assets is long-term. When somebody develops a discretionary trust fund they can call a trustee and several follower trustees to manage it.

Can you take money out of an optional depend on?

- might be established in respect of all or part of the Estate, for

- instance: "I leave my Estate to my trustees who will divide my estate in between the complying with persons my widow, my youngsters, my grandchildren and

- more problem, any called charities or any called individuals. & #x 201d; This gives flexibility and may ... If a trustee is an individual, the function normally can not be passed to a successor under the "trustee's Will. In lots of discretionary trust funds, the trustee has no right to nominate their successor and instead, the appointor (who can designate a new trustee )is entrusted to decide who becomes the new trustee of the depend on. If a recipient of an optional count on passes away, no part of the discretionary trust will drop within the recipient's estate. Since, under typical circumstances, HMRC can not impose an inheritance fee on a discretionary depend on beneficiary, any inheritance tax fees will emerge on the trustees rather. Safeguarding properties Due to the fact that the trustees you designate will have overall control over when to release a recipient's inheritance, it enables you to potentially leave properties to people that: Can not handle their own affairs, perhaps due to the fact that they are not old sufficient or they do not have the mental capacity. Trustees. The trustees are the lawful owners of the assets kept in a count on.